Credit card reform went into effect in February, have you noticed any changes on your statement? Credit card companies are required to give consumers more disclosure on credit card statements. The new Minimum Payment Warning section shows consumers the cost of paying the minimum payment only.

Credit card reform went into effect in February, have you noticed any changes on your statement? Credit card companies are required to give consumers more disclosure on credit card statements. The new Minimum Payment Warning section shows consumers the cost of paying the minimum payment only.

In my post Credit Card Reform is Here, I questioned whether the minimum payment information would change consumer behavior. I wrote “It will be interesting to see if consumer behavior is different — once credit card companies start revealing the amount of time it takes to pay off a credit card balance when making minimum payments only.”

Have you seen the Minimum Payment Warning on your credit card statement?

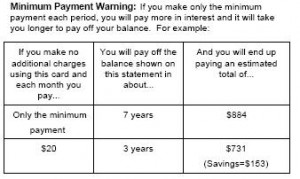

As you can see in the picture, there is a special section titled “Minimum Payment Warning” and it gives you more insight into how long it could take to pay off your balance and how much it may cost you — when you pay the minimum payment only.

Let’s take a closer look at the new Minimum Payment Warning section on my recent credit card bill. According to my credit card statement:

- Credit card balance was $626.35.

- Minimum payment is $12.00.

- The Minimum Payment Warning statement tells you upfront that if you make the minimum payment only, you will pay more and it will take you longer to pay it off. That’s nice, but how much more? How long will it take to pay it off?

- The chart that follows shows you an example of how long it could take and how much money it may cost you making the minimum payment only (on the current balance). For example, if I paid the minimum payment every month, it could take me 7 years to pay off the original balance ($626.35) and may cost a total of $884. That’s over $250 in interest, $257.65 to be exact.

- The next row shows you how paying just a little more every month helps you save money and reduce the repayment period. According to the example if I paid $20/month ($8 more than the minimum payment), then I would save $153 and cut the repayment period by about 60% to 3 years.

Do you think the Minimum Payment Warning will make a difference in the way consumers pay or use credit cards? Please share your thoughts using comments.

Tip: It’s a good money habit to pay your credit card bill off every month to avoid any finance charges. If you think of credit like cash it will help you manage it better.

Please pardon my language, but when I first saw the minimum payment warning I felt like a sucker. The table comparing the two payment scenarios really spoke to me. And it said: even we the credit card companies are telling you paying the minimum payment is a costly idea (although they are required by law). It was at this point that I felt that I was out of excuses and decided to go into balance attack mode.

Alongside your question I wonder how many people even look at their statements? It’s very easy to setup auto-debit to pay the minimum each month.

I’ve written a bit about the minimum payment warning on my own blog. I made a handy little slide calculator: http://breadfromscratch.com/tools/credit-card-minimum-payment-warning-calculator/

Thanks for sharing your minimum payment tool John! It’s very helpful.

You have a point about wondering how many people even open up their statements. Hopefully, my post Top 5 Reasons to Open Your Bill will encourage those who don’t today to start.

I wish that these disclosure laws had been out there years ago. I really struggled with debt for a long time. A person can bury themselves in debt in no time. I am happy to say that I am do typically pay my credit card balances off every month now except for “same as cash” deals which is why I landed on this site today. I am confused because I have a new credit card because of something that I bought on 6 months same as cash and I was looking at my bill to determine how to pay it off on time. There is no mention that I can see of my same as cash deal. What confuses me is the “minimum payment warning”. My balance is $825.72. My minimum payment warning says that if I pay my minimum payment of $29.00/month, I will pay off my balance in about 2 years and pay a total of $826.00. First of all, 825.72/29 = 28-1/2 months without any interest added! Then there’s the matter of a total of my payments that equals my original balance????? Who enforces these laws and if I wanted to report this, who would I contact?

Greg, that’s great to hear that you’ve gotten out of debt. And are paying off your balances every month.

Given your current situation, I would start by giving the credit card company a call to ensure that the same as cash agreement is reflected on your account. Be sure to discuss the full terms of your same as cash agreement. For example, the exact date your account needs to be paid off to avoid any interest charges.

To answer your questions: