A recent FDIC survey showed nearly 10 million U.S. households are unbanked. And 24 million are underbanked. It also revealed that most of these households use high cost alternatives like check cashers and payday lenders to manage money.

A recent FDIC survey showed nearly 10 million U.S. households are unbanked. And 24 million are underbanked. It also revealed that most of these households use high cost alternatives like check cashers and payday lenders to manage money.

Who are the unbanked and underbanked?

The unbanked do not have any type of account (e.g. checking, savings) with an insured financial institution (e.g. bank, credit union). The underbanked have an account, but they also depend on alternative methods to handle their finances.

These alternative methods include prepaid cards, check cashers, money orders, pawnshops, payday loans and rent-to-own services. Many of which could come with costly fees and high interest rates.

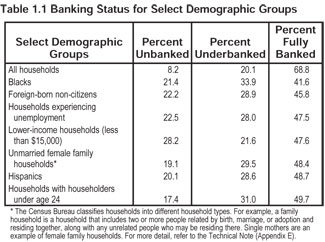

The FDIC survey table below shows us the demographics behind the unbanked/underbanked. Most of them are minorities, the unemployed, single mother households, lower-income households and young people.

Why are people unbanked?

As you can see from the demographics a large portion of the unbanked have low-incomes or are unemployed. So it’s not surprising to see that not having enough money to open and fund an account is one of the top reasons they are unbanked.

In fact, Mississippi has the highest poverty rate and the highest percent of people unbanked. On the flip side, New Hampshire has the lowest poverty level and the lowest percent of people unbanked.

But income is not the only factor why people are unbanked. Some people didn’t feel they needed or wanted an account.

There are many reasons to have an account. Some of the key benefits are:

- Accounts are insured up to $250,000. This helps give you more peace of mind that your money is safe and secure.

- More convenience. You can receive direct deposits (saving you money on check cashing fees) and use online banking.

- Save money. I read where some people are spending as high as $48 month cashing checks. That’s $576 a year. Opening an account could save you money given the average account is $12 – $15 a month.

- Build credit history and pay lower interest rates. Credit cards normally charge you lower interest rates than payday lenders. Plus, they give you an opportunity to build a good credit history.

Other reasons why they are unbanked included:

- They don’t trust or feel comfortable at banks.

- The balance requirement, service charges and fees.

- And they have ID, credit or banking history problems.

Trust is a big issue when it comes to bank accounts. But you can combat this issue by choosing a financial institution that you trust. Do the research and verify it is FDIC or NCUA insured. And actively manage the money in your account.

As for balance requirements, service charges and fees. It’s a good idea to understand how your account works before you open it. There are many banks and credit unions out there to choose from.

You have to bank smart to avoid the financial pitfalls. In my book “Get Your Money Right”, I describe the different types of banking accounts and provide readers with a list of questions to ask and consider before opening an account. It’s also packed with a lot of tips to save money, manage your account and avoid fees.

If you have credit problems, check out 5 Steps to Improve Your Credit Score.

Have you been denied a bank account? Many financial institutions use ChexSystems to identify high-risk applicants. The information gives them information about your banking history. You can get a free copy of this report every year and dispute any errors. Read this article to find out how to open a second chance account.

Next time I’ll share some real talk from the underbanked.

Until then, what are your thoughts? Are you unbanked/underbanked? Why or Why not?

Photo: epicharmus