How to Save on Prom

Did you know the average cost of prom is estimated to be $600 - $1,000+? There’s even something called “prom inflation”, which has some teens spending $2,000 on one night. That cost just blows my mind! In this post, I’ll share some tips on how to save on prom. My...

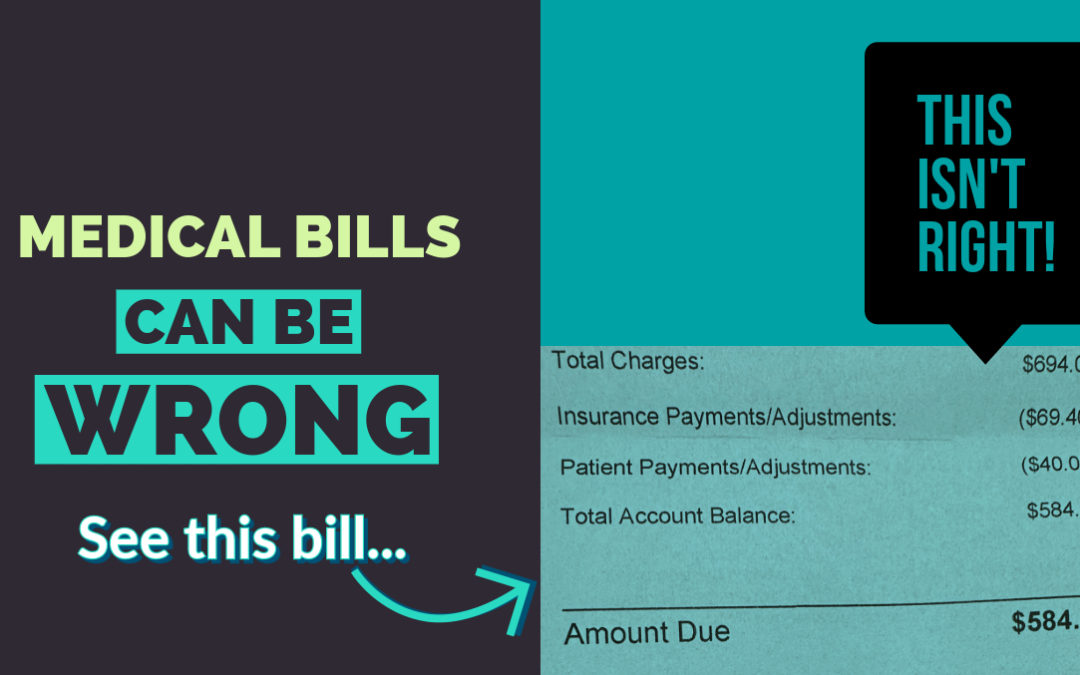

Medical Bills Can Be Wrong

It’s true that planning ahead can help you save money on your healthcare. But understanding how your healthcare insurance plan works is essential. For example, you may save more with in-network medical services than out-of-network. And some healthcare procedures may...

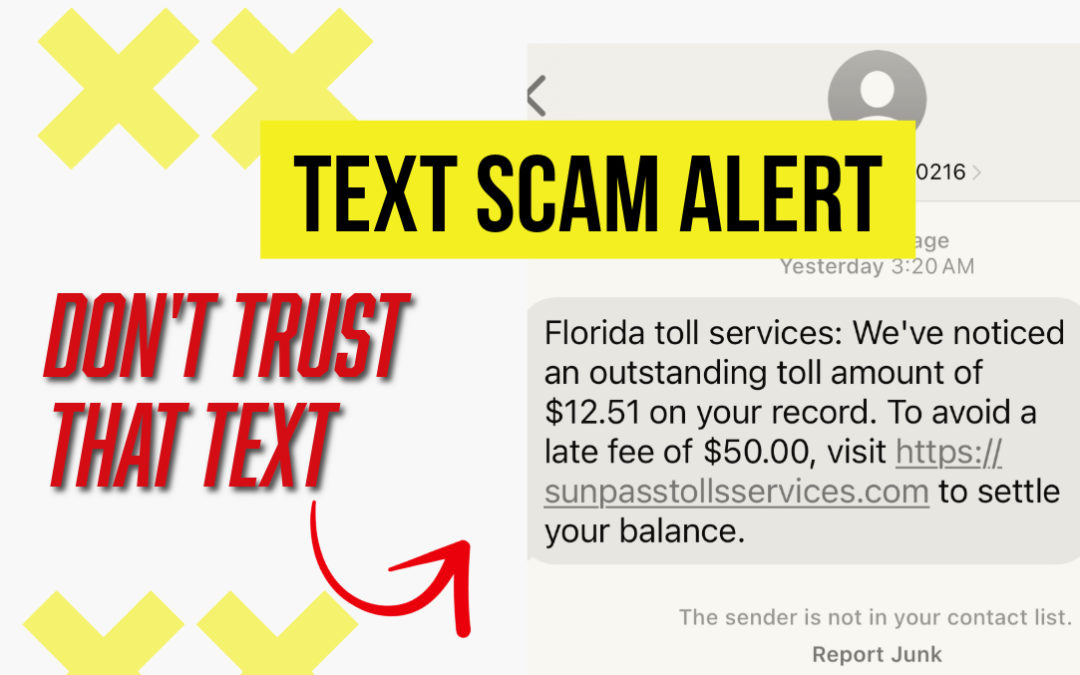

5 Ways to Spot a Scam

Scammers are relentless in their pursuit of your — hard-earned money. They try to reach you in many ways: phone, email, text, social media, and it could be a knock on your door. Learn how to spot a scam, so you can protect yourself and your money. Here are 5 Ways to...

Make 2024 Your Year to Shine

It’s been a while since my last blog post, nearly four months to be exact. Now we’re over halfway through January 2024. How about that? I hope your new year’s off to a great start. There’s just something about the changing of the year. It can mark a new beginning...

Buying a House? Three Important Things No One Tells You

Are you in the market for a new house? Sometimes the process moves super-fast. I know the inventories can be low, interest rates high and bid wars are real. But it’s important to pause and think. There could be some important things no one is talking about. Here are...

5 Tips to Pay Off Debt

The other day on Money.com, the hot trends were all about these four letters — DEBT. They were on topics like car loans, student loans, and credit card debt. The last one read “Here’s How Much Debt the Average American Has in 2023.” If you read it, you’ll discover...

$4 Movie Tickets on National Cinema Day

Grab a $4 movie ticket (plus tax) this weekend. Many theatres are offering moviegoers this ridiculously low ticket price to celebrate National Cinema Day on Sunday, August 27, 2023.

Biden’s New SAVE Income-Driven Student Loan Plan

The Biden administration announced a new income-driven student loan program called Saving on a Valuable Education (SAVE) Plan to make paying off student loan debt more affordable. This new plan could cut payments in half or even down to zero for those who qualify.

Beware of Penalty APR on Credit Cards

The other day my friend was upset about her credit card bill. She said, “It’s so hard to pay it off when you’re paying a 32% interest rate.” Her rate was so high, it sounded like a penalty APR to me. Let me explain. Since we’ve...