It’s true that planning ahead can help you save money on your healthcare. But understanding how your healthcare insurance plan works is essential. For example, you may save more with in-network medical services than out-of-network. And some healthcare procedures may require a preauthorization or prior approval to receive medical coverage. Still, there are times when medical bills can be wrong to no fault of your own.

Sometimes the more you know, the more you can save. Calling ahead to get a cost estimate could help you to avoid frustration later. For example, a friend of mine’s doctor suggested she get a colonoscopy. She listened to this advice, scheduled the appointment, and had the procedure.

Then, she received sticker shock in the mail with an unexpected big bill. Apparently, her healthcare provider only fully covered a colonoscopy as preventative when you are 50-year-old or older. Unfortunately, she had the procedure less than a week before her 50th birthday.

She was so upset to hear the 50-year-old age requirement, especially given she was only a week away from it. It wasn’t urgent and she could have waited a week to avoid the extra expense. Insurers often allow you to appeal a medical claim benefit decision. So, she submitted an appeal for the charges given she was so close to the age of 50 and unaware of the age requirement. Despite her tremendous efforts to appeal the charges, she was denied and had to pay the high medical bill.

Check Your Medical Bills

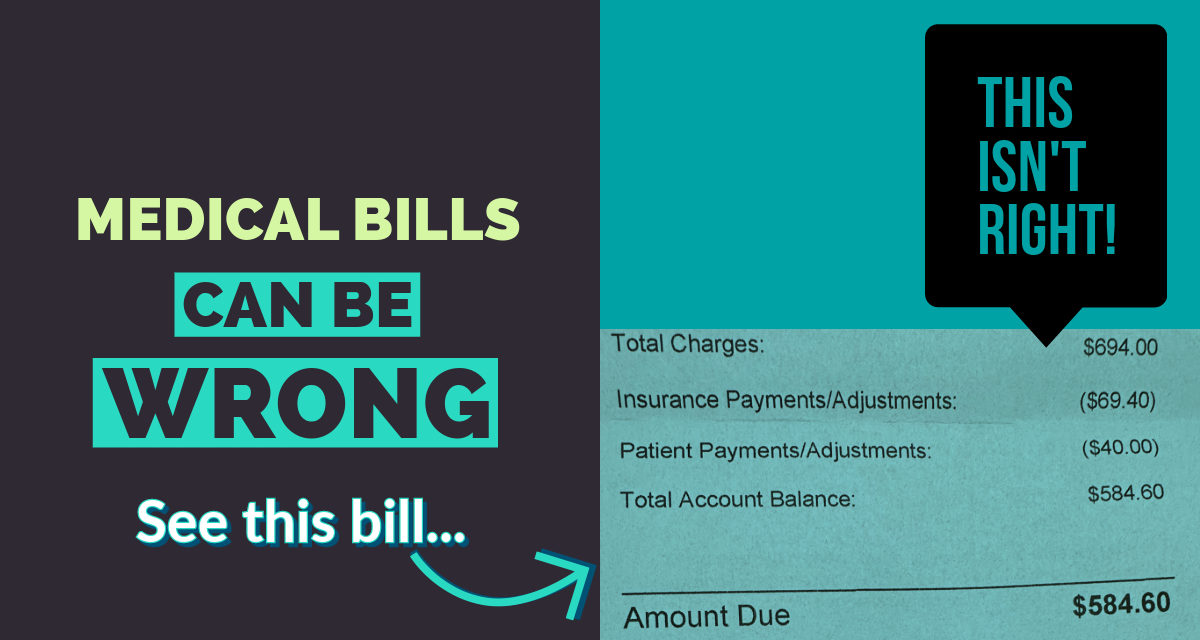

Mistakes happen. A simple coding issue could result in a billing issue. There are a number of things that can result in incorrect billing. For example, the other day I went to see a specialist and paid my normal $40 copay. A few weeks after the appointment I got an email with a bill for nearly $600 for that appointment. I thought it was a big mistake because this had never happened with my past appointments. Then, reality set in when my explanation of benefits and paper bill in the mail confirmed the charges due of $584.60.

Instead of paying the ridiculously high bill, I called my healthcare provider to question the billing. The representative told me my in-network doctor was now out-of-network. I explained that my doctor has always been in-network, which is why they charged me the $40 at my appointment. She then put me on hold for several minutes while she looked up their contract with my doctor.

After a closer review, she discovered that he was an in-network doctor. My claim had been processed incorrectly as an out-of-network bill. She apologized for the mistake and resubmitted the medical claim to get the bill corrected.

Now, can you imagine if I didn’t question the medical bill? I would have been out of $40 plus another $584.60, totaling $624.60 vs. $40.

Are You Being Overcharged for Medical Bills?

Know Your Medical Bills Rights

As a consumer, you have rights when it comes to your medical bills.

There’s a No Surprises Act intended to help protect you from any surprise medical bills. This includes costs for emergency services, out-of-pocket costs, in-network and out-of-network expenses. The video below goes more in detail on the No Surprises Act:

Got Medical Bill Debt?

For more information on your medical bills rights, including collections, check out the Consumer Financial Protection Bureau’s “Know your rights and protections when it comes to medical bills and collections.”