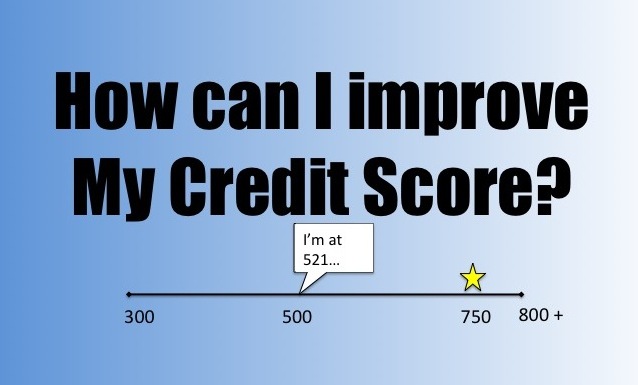

Your credit score matters. A good credit score can open up new doors for you. Last week, I joined Experian’s #creditchat and we discussed “How to Boost Your Credit Score.”

Here are some tips from that #creditchat to help you improve your credit score.

What’s a Good Credit Score & Why Does it Matter?

U.S. News columnist @BeverlyHarzog shared, “A “good” FICO score is 670-739; a “very good” score is 740-799; and an “exceptional” is 800+. Strive for a 760 score for best rates. If you’re below 670, you’ve got fair credit & you’re subprime, which means high rates & decreased access to some types of credit.”

In my experience, 700 and above is generally considered to be a good credit score. Your credit score matters because it helps to determine how much you pay for services and financial products. It’s also used to determine your creditworthiness for getting approved for credit (credit cards, loans). And some employers may evaluate your credit for a new job.

@TheLoadedPig stated, “Lenders use your credit score(s) to determine your creditworthiness or how likely you are to repay a line of credit. Having a high credit score can actually save you thousands of dollars on loans, security deposits, credit cards & even insurance!”

As you can see, a good credit score can help you receive easier approvals and save more money in interest rates, security deposits and it may even help you get lower insurance premiums.

Manage Your Credit

That’s why it’s best to stay on top of your credit, so you don’t get any surprises (fraud, discrepancies). Checking your credit score regularly is a good habit for credit management. Some credit cards, banks and credit card statements make this easy to do every month.

You can also order a free copy of your credit report every year from each of the three credit reporting companies (Equifax, Experian and TransUnion) at AnnualCreditReport.com. And now they are offering a free credit report every week during the coronavirus pandemic. Read my blog post -> New: COVID-19 Free Credit Report Every Week for more details.

Fact or Fiction: Do Credit Card Balances Help Your Credit Score?

When it comes to carrying a balance on your credit card it could help or hurt your credit.

For example, if you’re over the credit limit on your credit card, then it will hurt your credit score. The amount of credit you use on your account is called credit utilization. Say you have a credit limit of $1,200 and your balance is $1,275, then you would have a credit utilization of over 100%.

It’s better for your credit score when you minimize your credit utilization to be 30% or lower. That means owing $300 or less on a $1,000 credit limit card. This should help your credit score.

If you have a credit card balance and pay it off every month, that could really help your credit score. For some useful tips on how to lower your credit utilization, check out NerdWallet’s article -> 5 Tips for Lowering Your Credit Utilization.

How to Build Your Credit with a Credit Card

Some people think credit cards are bad or pure evil. I’m not one of those people. A credit card is a tool to help build your credit. If you use it responsibly, there are a lot of perks that you can receive with a credit card (e.g. cash back bonuses, warranty protection).

The best way to build good credit using a credit card is to buy what you can afford to pay off every month. So you can enjoy all of the perks of paying with credit without the pain of paying ridiculously high interest and credit card fees.

Beverly Harzog says, “With limited credit, apply for a secured credit card or a student card (if eligible), become an authorized user or apply for an unsecured card that targets fair credit. Use the card every month, keep low balances and pay the bill in full by the due date.”

While The Loaded Pig suggests you:

- Pay off the balance each month in full

- Don’t spend more than you can afford

- Keep utilization low

- Set up automatic payments for the min balance

- Set reminders for the full balance

Do You Need a Credit Limit Increase?

Evaluate your financial situation to determine if a credit limit increase is necessary. If you need a credit limit increase, the best way to ask for it is to call your creditor.

How to Increase Your Credit Limit (Without Harming Your Score)

How To Build Your Credit Without a Credit Card

Experian has pioneered a set of tools for credit empowerment called Experian Boost. It’s a completely free service you can use to help you improve your credit score. For instance, Experian Boost allows you to get credit for the monthly payments you make on services like utilities.

Experian Boost could help you get credit for making utility, cell and other types of payments you make on services every month. For more information on this program check out this post -> Add Your Cell Phone Payments with Experian Boost

Final Thoughts

One of the biggest factors in your credit score is payment history. So pay on time. Also monitor your credit utilization to keep it at 30% or lower. Lastly, limit your credit inquiries & “just say no” to offers you don’t need or want.

Finally, be careful about co-signing on a loan for someone. When you are a joint owner on an account, you are equally responsible for making the payment. If they don’t pay, then you have to or else your credit score could suffer.